It’s the beginning of a new year, so folks are sharing all sorts of ideas for saving money.

There’s the 52-week challenge, the $5 bill challenge, and hundreds more to choose from.

As a lady who loves a good challenge, it’s always fun to discover new ways to save.

I remember when there was a time when putting money away for a rainy day didn’t seem like an option.

I’ve shared before that I wasn’t living paycheck to paycheck, I was paycheck to paycheck AFTER that paycheck.

The few times I was able to save, I felt accomplished, and proud of myself.

During those extra lean years, I took my daughter on vacation with money that I was able to save up. It’s still one of my favorite memories.

Emergencies come up. Life happens. Knowing you have a little money in the bank will give you peace of mind when the unexpected happens.

If you can barely afford to pay bills, here are a few ideas of ways that you can save money anyway.

1. Start small. Really small.

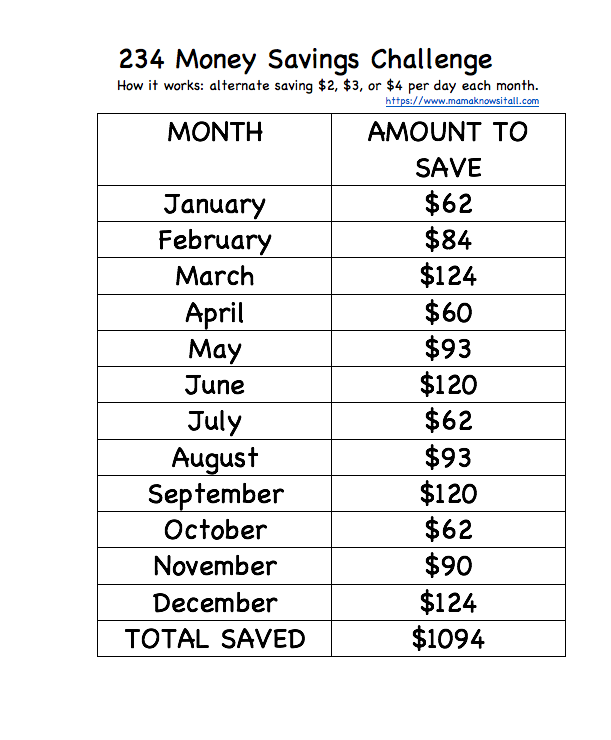

A dollar or two on its own may not have a huge impact, but it does add up. Try my 234 Money Saving Challenge to save a little over $1000 this year.

Here’s how it works:

Each month you alternate between saving $2, $3, or $4 a day. So, for January, you’d save $2 x 31.

At the end of the month, you’ll have saved $62.

In February, you’ll save $3 x 28.

March would be $4 x 31.

Then you start over again with saving $2. (Click to print this handy chart!)

Don’t discredit your change, either. My grandparents used to have a humongous glass bottle that was filled with coins. I never did find out how much was in there, but I wouldn’t be surprised if it was thousands of dollars!

Don’t discredit your change, either. My grandparents used to have a humongous glass bottle that was filled with coins. I never did find out how much was in there, but I wouldn’t be surprised if it was thousands of dollars!

Not too long ago, I took all of the change that I had in different purses to the bank to cash them out.

I had almost $70 and I rarely use cash! Find a big box, bag, or bottle to put your change in, and don’t touch anything you put into it until the end of the year.

Hardcore idea: If saving money is really, really hard for you, get $10 worth of quarters from the bank every time you get paid. Put them in your change box to save.

2. Put your money somewhere that it can’t be touched.

There were times when I had a few extra dollars to put towards savings.

I put it away, but as soon as things got a little tight, I was in the account snatching it right back out.

Putting your money in an account that has to mature before you can get to it will help.

If your company has a 401K program, especially if they match it, make sure you’re contributing to it.

Choose $10 or $20 for each paycheck, and if your company matches, there’s a good chance you’d be putting away almost $100 a month.

While this money isn’t easily accessible if you need it for something like gas, if you are on the verge of getting evicted, there is a hardship option to get your funds.

You’ll end up paying a penalty and taxes, but I know it made me feel better knowing that I could access my money if I absolutely needed to.

Alternately, many banks have Christmas savings clubs where you add money to an account and you only have access to it from October to December.

You can probably have funds automatically deducted from your checking account and move it right over to your Christmas account.

3. Sign up for a Self Lender account

Self Lender (this is my referral link) is a credit builder account.

You contribute a little less than $50 monthly to an FDC-certified CD that matures in 12 months.

There’s a small setup fee of about $12, then you pay into your account each month.

They report to all of the credit bureaus, so if you need to build your credit and save, this will do double duty for you. At the end of the 12 months, the funds are returned to you. It’s easy, peasy!

4. Change your money mindset.

I know what it feels like when every dime seems to be allocated to a bill.

I know some folks would tell you to give up your coffee, or take lunch, but when times are really tough, I know how those little treats can give you the pick-me-up that is necessary to keep on keeping on.

However, if you can buy a cheap coffee maker and an adorable travel mug, maybe you can make your coffee at home and take it with you a couple of times a week.

Put the $5 or $6 you’re saving into your account.

Even if you don’t save a huge amount this year, just the act of consistently putting money away will help you to change your money mindset. It’ll show you that you are capable of saving money, and you’ll likely be ready to save even more next year.

![]()

Other posts you might enjoy:

It’s not too late to protect your retirement

How to go on vacation when money is tight

These 18 tasks will make sure you’re ready for the new year